Rabbit Finance

Leverage Farming Protocol for Big Profits

The world has witnessed the inevitable increase of DeFi's decentralized finance from 2020. This trend is likely to get stronger and encourage many new businesses to emerge. Judging from the lending, money management, and exchange program data of Defi, Defi meets the real needs of many investors, which makes the data continue to increase in the chain. At present, the total number of Defi lockouts has exceeded 100 billion USD worldwide.

That's because Defi has grown in the blockchain market, the birth of Defi allows investors to experience the allure of decentralized financial services. Whether it is a loan, insurance, or money management, it is executed through a code on a chain or predefined rules automatically and without the risk of black brokerage casework. On the one hand, investors tend to be calmer because their funds are held by them; on the other hand, the use of funds is increasing and they have more options when choosing and adjusting their investment strategy.

Currently, various kinds of Defi are popping up endlessly. However, the one-stop Defi product that can meet all types of needs is still not on the market. In this context, Rabbit Finance emerged.

What is Rabbit Finance?

Rabbit Finance is a Binance Smart Chain (BSC) based agricultural product protocol released by Rabbit Finance Lab. It supports users participating in liquidity farming through excess borrowing plus leverage to earn more income.

When users have insufficient funds but want to participate in DeFi's liquidity farm, Rabbit Finance can provide up to 10X the leverage to help users earn maximum revenue per unit of time, and at the same time provide loan pool for users who prefer stable returns. to make a profit.

Rabbit Finance is a leveraged farming protocol built on top of the Binance Smart Chain. This allows yield farmers to get higher returns by opening leveraged positions.

Rabbit Finance is a leveraged yield farming protocol based on the Binance Smart Chain (BSC) released by Rabbit Finance Lab. It supports users participating in liquidity farming through excess borrowing plus leverage to earn more income.

When users have insufficient funds but want to participate in the Defi liquidity farm, Rabbit Finance can provide up to 10X the leverage to help users get the maximum revenue per unit of time, and at the same time provide a loan pool for users who prefer stable returns. to make a profit.

What is RABBIT Token?

The RABBIT token is the Rabbit Finance platform governance token. It will also capture the economic benefits of the platform. There will be a maximum of 200 million RABBIT tokens.

Rabbit Finance features and values

1. Cora

lenders deposit their BNB in our safe; the assets are available for borrowing by the yield farmers; he earns interest for providing this liquidity.

2. If

yield farmer wants to open a leveraged yield farm position in the BTC / BNB pair; he borrowed BNB from the vault and enjoyed higher yielding agricultural produce.

3.

Rabbit Finance smart contracts handle all the behind the scenes mechanisms optimally transferring assets to the right ratios, providing liquidity to the pool, and staking LP for Pancake Rewards

4. Gary

The liquidator monitors the health of each leveraged position, and when it exceeds the prescribed parameters, he helps to liquidate the positions, ensuring that such a lender does not lose his capital. For this service, he takes a 5% reward from liquidated positions.

5. James

the bounty hunter keeps track of the amount of bounty earned in each batch and helps reinvest it, combining returns for all farmers. For this service, he takes 0.4% of the prize pool as a reward. 30% as buyback funds, which will be used for RABBIT buyback and deflation. The remaining 69.6% will be converted into LP from the pool and promise again to get multiple returns.

Additionally, when bounty hunters pitch in the pool and make reinvestments, 30% of the bounty pool is used as repurchase funds to promote the token's value.

Why does reinvestment increase token value? This can be explained by the relationship between supply and demand in economics. When demand exceeds supply, the asset value will inevitably increase. According to the Rabbit Finance deflation mechanism, 30% of reinvestment revenue is used to buy back funds to achieve sustainable token deflation. In the author's perspective, the Rabbit deflation mechanism will be a vital factor in realizing the token price. Continuous buyback and disposal allows the volume of token supply to decrease on a limited scale. This will encourage the token to become even more valuable. When Rabbit reaches its implementation, the token price is expected to increase simultaneously.

30% of the bounty pool is used as buyback funds to promote the value of the token. For this service, 0.4% of the bounty pool is given directly to the bounty hunter as a reward, the remaining 69.6% will be converted into pool LP and another promise of multiple returns. The immense power provided by repeat investing allows investors to earn more.

Except for the increase in value driven by token deflation, Rabbit has several other values. For example, before Rabbit appeared, the gun pool token could do nothing but regulate. However, Rabbit holders can mortgage their shares to the board to distribute bonuses. As long as Rabbit Finance is profitable, the holder is given the right to distribute bonuses as shareholders and make money easily.

NFT (Non-fungible Token) is a growing niche market for almost anyone to take the opportunity. Specialists estimate that NFT has the potential to become one of the world's largest markets. The Rabbit Authority has thought a lot about its token. Rabbit Finance Lab will continue to empower Rabbit tokens, for example Rabbit holders can take NFT artwork that is issued irregularly, and Rabbit will be automatically locked during this period. Its circulation will be blocked and its value is expected to be withdrawn in the short term. Holding an NFT can speed up mining, empowering the NFT with value with Rabbit's help.

The two parties are a reciprocal relationship, meaning that holding Rabbit allows the NFT holder to hold, the NFT token appreciation reacts to Rabbit's appreciation.

How to Participate?

1. As a user, you can participate in Rabbit Finance in four different ways:

- Lenders: Rabbit Finance allows you to earn income on your basic assets by depositing them in our vaults. These assets will then be offered to yield farmers to increase their position.

- Farmers: As a farmer, you can get higher yields by opening a leveraged position with Rabbit Finance. Of course, this comes with a bigger risk: liquidation, variable losses, etc.

- Liquidators: Monitor ponds for underwater positions and liquidate them when they become too risky.

- Bounty Hunter: Prize hunter in pool and execute reinvestment, 30% of bounty pool is used as buyback fund to promote token value. For this service, he takes 0.4% of the bounty pool as a reward, the remaining 69.6% will be converted into pool LP and promises again to get a combined return.

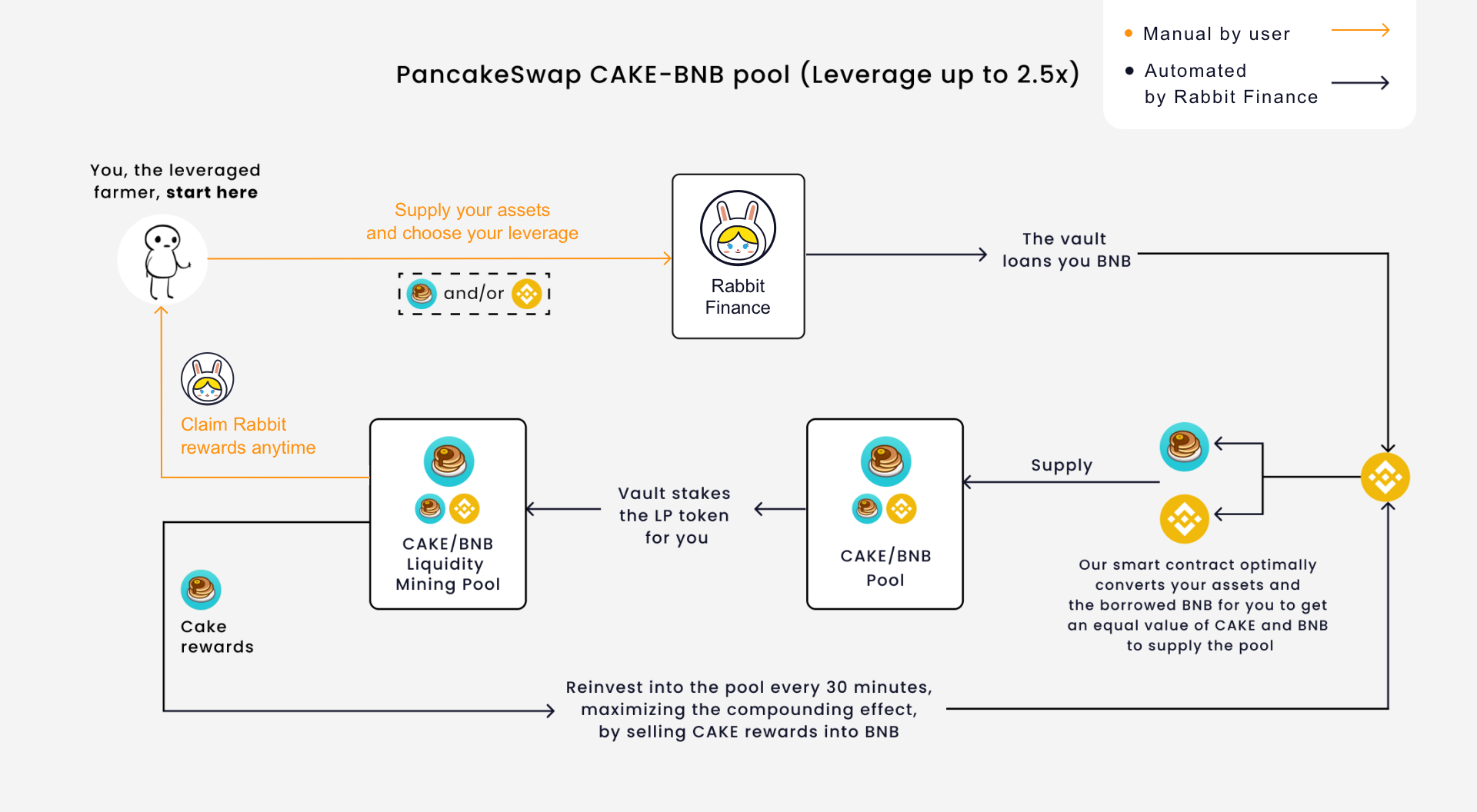

At launch, we will support the two basic assets of BNB and BUSD, and integrate our leveraged farm with PancakeSwap.

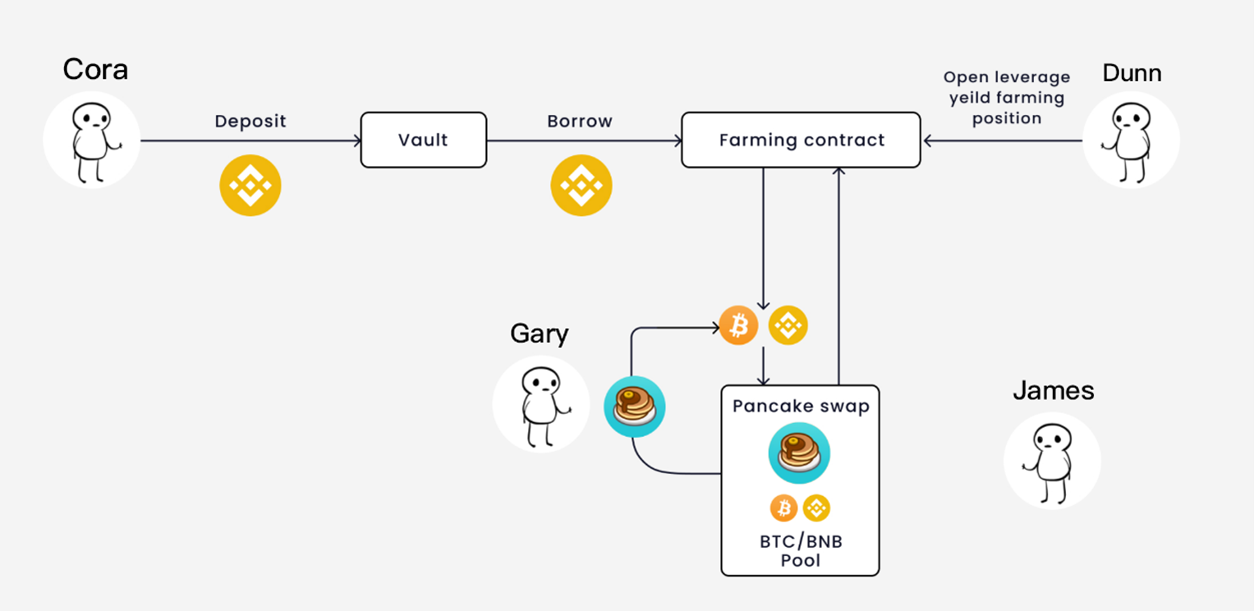

2. In the example below, we show how each participant works together in our ecosystem:

- Cora, the lender deposits his BNB in our safe; the assets are available for borrowing by the yield farmers; he earns interest for providing this liquidity.

- Dunn, the yield farmer wants to open a leveraged yield farm position in the BTC / BNB pair; he borrowed BNB from the vault and enjoyed higher yielding agricultural produce.

- Rabbit Finance smart contracts handle all the behind the scenes mechanisms optimally transferring assets to the right ratios, providing liquidity to the pool, and staking LP for Pancake Rewards

- Gary, the liquidator monitors the health of each leveraged position, and when it goes beyond the prescribed parameters, he helps to liquidate the positions, making sure the lender doesn't seem to lose his capital. For this service, he takes a 5% reward from liquidated positions.

- Bounty hunter James keeps track of the amount of bounty earned in each batch and helps reinvest it, combining returns for all farmers. For this service, he takes 0.4% of the prize pool as a reward. 30% as buyback funds, which will be used for RABBIT buyback and deflation. The remaining 69.6% will be converted into LP from the pool and guaranteed again to get multiple returns.

What are the RABBIT tokens used for?

Protocol Governance

soon launched a governance vault that will allow community members to stake their RABBIT tokens. RABBIT Stakers will receive xRABBIT where 1 xRABBIT = 1 vote, enabling them to decide on major governance decisions. In the initial phase, governance decisions will be made on the Snapshot.

Capture the Economic Benefits of the Platform

Rabbit Finance Protocol users (depositors and borrowers, i.e. lenders and farmers) will be given RABBIT tokens for their deposit and loan behavior. The Rabbit Finance platform will prepare a buyback fund with its income, which will be used for deflation and appreciation of the RABBIT token. When the income is reinvested, 30% of it is used for the RABBIT buyback fund. 20% of the depositor's interest income is used as a market development fund. All of this will contribute to increased demand and growth in the value of RABBIT.

Get Economic Benefits from RUSD, RBTC, RBNB

The RABBIT token is a shareholder rights token of the algorithm stable coins RUSD, RBTC, RBNB, etc. Whenever RUSD etc is experiencing inflation, members who pledge RABBIT tokens to the meeting room will distribute additional RUSD as dividends to share the benefits of ecological growth. For more details, please pay attention to our follow-up announcement.

Strength & Vision

Rabbit Finance fully leverages and adopts the advantages of projects in the market, using over-exploited agricultural products with the advantages of Alpaca Finance and Badger Finance, creatively incorporating an algorithm-stable coin mechanism to empower the RABBIT token. Across the economic ecology of Rabbit Finance, the RABBIT token, endowed with more application scenarios, represents not only the governance rights and interests of the leveraged farming protocol, but also the token rights and shareholder interests of the RUSD algorithm stable coin. Whenever the RUSD experiences inflation, members who pledge R tokens to the meeting room will distribute additional RUSD as dividends to share the benefits of ecological growth.

Rabbit Finance believes that the leveraged yield farming platform will be the next killer app in the Defi field after a decentralized exchange and lending platform. It is also believed that the algorithm stable coin is the last Holy Grail in the Defi field. They are and will be the most important infrastructure in the world of Defi.

Rabbit Finance's vision is to become the Federal Reserve of the Defi world, based on the principles of equal opportunity and commercial sustainability, and to provide appropriate and cost effective financial services for people of all social walks of life and groups who need financial services. Rabbit Finance is not a simple leveraged farming platform or an algorithmically stable coin system. It will be a decentralized and inclusive financial services infrastructure with sustainable hematopoiesis capabilities and based on blockchain technology. Compared to the same role as the Fed, what Rabbit Finance expects goes far beyond the role of the Fed in the world economy.

RABBIT distribution

Community Pool

79.75% of the total supply, around 159,500,000 RABBIT.

RABBIT will be released over two years on a rotting emissions schedule, and will be distributed evenly throughout the ecosystem as a community reward.

Institutional Base

5.25% of the total supply, 10,500,000 RABBIT

Provide investment quota of 5.25% for well-known institutions and investors. After the investment is complete, 245,000 RABBIT will be released every 7 days, and 10,500,000 RABBIT will be released within 300 days (about 10 months). The specific time to be determined, please pay attention to the follow-up announcements.

Hard hats: 10,500,000 RABBITS = 525,000 USDT

Exchange rate: 1 RABBIT = 0.05 USDT

Development Fund

5% of the total supply, around 10,000,000 RABBIT.

5% of the tokens distributed are reserved for future strategic spending. In the first month, 250,000 tokens were released for listing, auditing, third party services and partner liquidity fees.

Community collection release program

The RABBIT token will be released over a two year period with a rotting emission schedule, and will be distributed evenly across the ecosystem as a community reward.

In total, there will be 159,500,000 RABBITS. In order to incentivize early adopters, there will be a bonus period for the first weeks. Below is our planned block reward schedule. Based on this, the profile of the circulating RABBIT supply can be plotted.

Conclude

Rabbit Finance takes full advantage of and leverages projects in the market, leveraging leveraged revenue products with the benefits of Alpaca Finance and Badger Finance, and creatively combining algorithms from algorithmically stable coins to strengthen the RABBIT token. In the overall economic ecology of Rabbit Finance, the RABBIT token, complemented by more application scenarios, represents not only the governance rights and interests of the leveraged farming protocol, but also the rights and shareholder interests of the algorithmically stable RUSD coin. .

Rabbit Finance offers up to 10x leverage to help users get maximum revenue per unit of time, while providing a credit pool for users who prefer a stable return on profit. Join our community.

related links

- Rabbit Finance website: http://rabbitfinance.io/

- Github: https://github.com/RabbitFinanceProtocol

- Twitter: https://twitter.com/FinanceRabbit

- Telegram: https://t.me/RabbitFinanceEN

- Discord: https://discord.gg/tWdtmzXS

- Contract info: https://app.gitbook.com/@rabbitfinance/s/homepage/resources/contract-information

- Audit report: https://app.gitbook.com/@rabbitfinance/s/homepage/resources/audit-report

- Username:TWIXXER

- Link: https://bitcointalk.org/index.php?action=profile;u=2579938

Komentar

Posting Komentar